The Cayman Islands has long been a magnet for global entrepreneurs, thanks to its reputation as one of the most attractive tax-neutral jurisdictions. With zero direct taxes on income, capital gains, or corporate profits, it’s no wonder the archipelago has become a hotbed for offshore companies, fintech startups, and hedge funds.

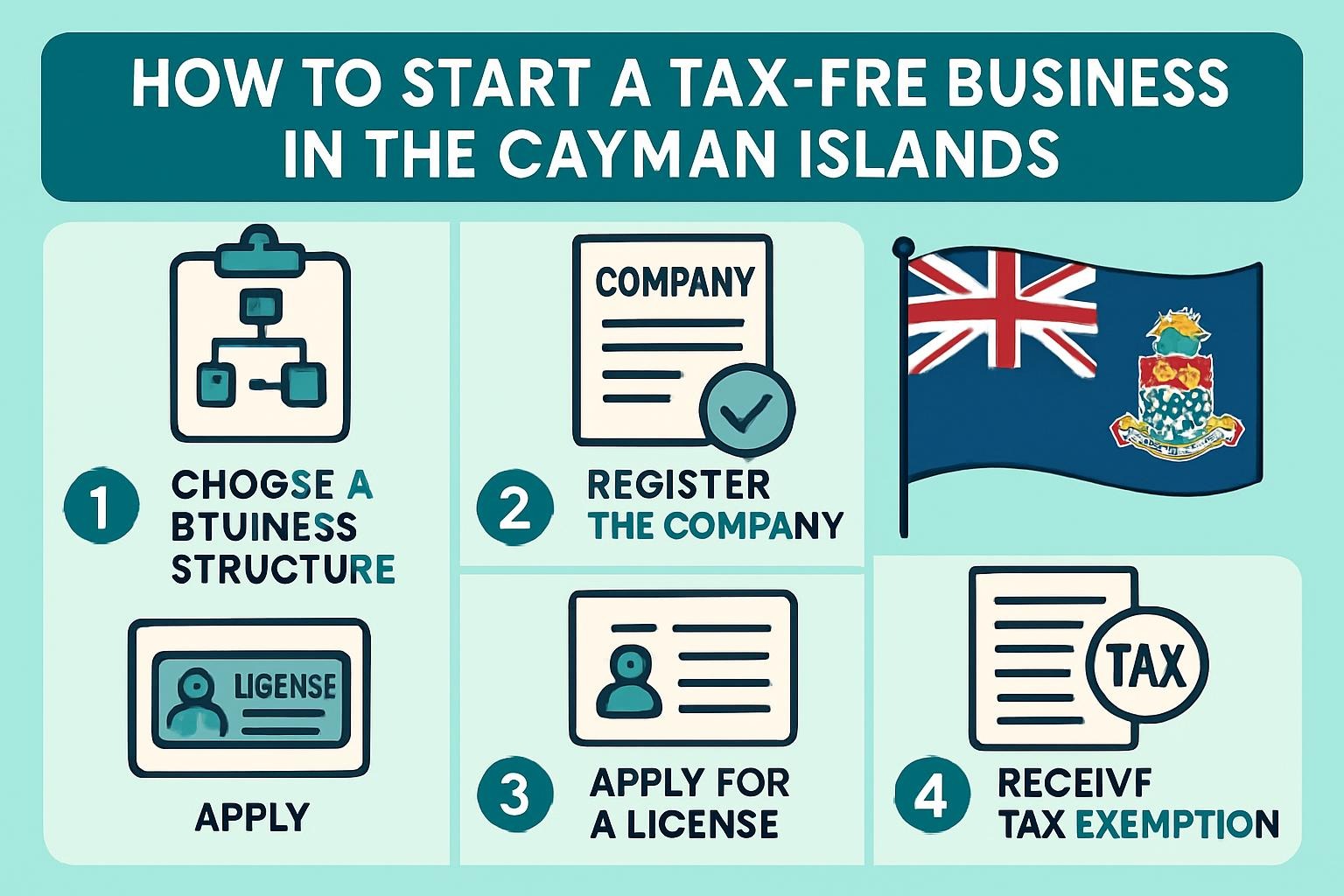

If you’re considering launching a tax-free business in the Cayman Islands in 2025, this guide will walk you through everything you need to know—step-by-step.

🌴 Why the Cayman Islands?

Before we dive into the “how,” it’s important to understand the “why.” The Cayman Islands offers:

- Zero corporate, income, and capital gains taxes

- No foreign exchange controls

- Political and economic stability

- World-class legal and financial services

- Strong privacy and confidentiality laws

- A fast and efficient company formation process

✅ Step 1: Choose the Right Business Structure

The most common type of offshore business entity is the Exempted Company. This is ideal for international operations and does not require local trading. Other structures include:

- Limited Liability Companies (LLC)

- Partnerships

- Segregated Portfolio Companies (SPC)

For most entrepreneurs looking to avoid local taxation, the Exempted Company is the best route.

📝 Step 2: Reserve Your Company Name

Make sure your desired business name is unique and doesn’t clash with existing entities in the Cayman Islands. You can check name availability and reserve it through the General Registry.

📄 Step 3: File Incorporation Documents

To register an Exempted Company, you must submit:

- Memorandum and Articles of Association

- Company registration form

- Details of shareholders and directors

- Registered office address in the Cayman Islands

Most companies use a local licensed service provider (law firm or corporate services agent) to streamline this process.

🧾 Step 4: Appoint Directors and Shareholders

There is no requirement for local directors or shareholders—you can be the sole owner and manager. However, you must maintain a minimum of one director and one shareholder (they can be the same person or entity).

🏢 Step 5: Establish a Registered Office

All Cayman companies must have a registered office on the islands. This can be a physical address provided by a corporate service provider. This office handles all legal and official correspondence.

🔒 Step 6: Ensure Compliance with Local Regulations

Though the Cayman Islands is tax-neutral, companies must still comply with anti-money laundering (AML) and beneficial ownership disclosure laws. You’ll need:

- A designated AML officer

- Due diligence procedures

- Annual filings and renewal fees

💼 Step 7: Open a Bank Account

Once your company is incorporated, you’ll need a corporate bank account. Cayman Islands banks have strict KYC (Know Your Customer) policies, so be prepared to submit:

- Proof of identity and address

- Business plan or purpose of the account

- Company incorporation documents

Many business owners also open accounts in other financial hubs (e.g., Switzerland or Singapore) for flexibility.

🌐 Step 8: Launch and Operate Globally

With your Cayman Islands company fully set up, you’re ready to operate internationally. Whether you’re launching a fintech app, running an investment firm, or managing intellectual property—your profits remain untaxed by local authorities.

🚀 Pro Tips for a Smooth Launch

- Use a reputable corporate services firm to handle legal and regulatory filings.

- Stay updated with any changes in international compliance standards (especially FATCA or CRS).

- Consider virtual office services if you don’t need a physical presence.

- Plan your exit strategy—Cayman companies are easy to dissolve if needed.

🔚 Final Thoughts

Starting a tax-free business in the Cayman Islands isn’t just for Fortune 500s or hedge fund managers—it’s accessible for global entrepreneurs, digital nomads, and startups looking to optimize taxes and scale quickly. With minimal bureaucracy, robust legal protections, and complete income tax freedom, the Caymans remain one of the top offshore jurisdictions in 2025.

If you’re ready to take your business global and tax-free, the Cayman Islands could be your ultimate launchpad.