The global banking system is a towering pillar of modern civilization. It moves trillions of dollars daily, underpins economic development, and influences the fate of nations. But despite its scale, it’s deeply flawed—plagued by inefficiencies, high costs, opaque processes, and limited accessibility for billions of people. Enter blockchain, the decentralized technology best known for powering cryptocurrencies. It’s more than a buzzword—it may be the key to a global financial revolution.

And that’s exactly why traditional banks are scared.

The Cracks in the Current System

Before diving into how blockchain could be the fix, it’s important to understand what’s broken:

- Cross-border transactions are notoriously slow and expensive. Sending money from the U.S. to Kenya, for example, can take days and cost up to 10% in fees.

- Banking the unbanked remains a colossal challenge. Over 1.4 billion people globally still lack access to banking services.

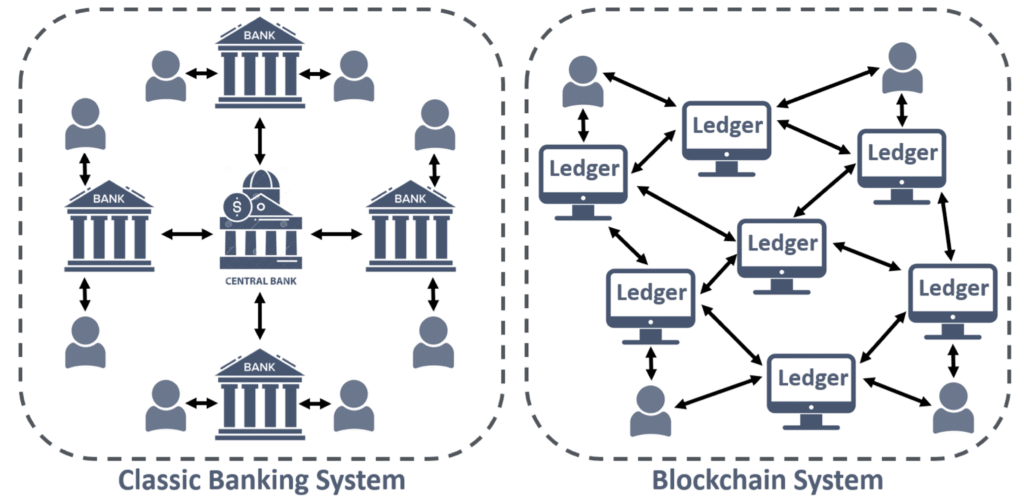

- Systemic risk and single points of failure mean when one large institution falters, it can spark a chain reaction (remember 2008?).

- Opaque record-keeping leaves room for fraud, corruption, and human error.

The irony? Banks rely on trust, yet they don’t always earn it.

How Blockchain Fixes the Fundamentals

1. Speed and Cost Efficiency

2. Global Financial Inclusion

With just a smartphone and internet connection, anyone can access blockchain-based financial services. No need for brick-and-mortar banks or lengthy paperwork. Cryptocurrencies and DeFi (Decentralized Finance) platforms are already helping unbanked populations in regions like Sub-Saharan Africa leapfrog traditional banking.

3. Transparency and Security

Blockchain’s distributed ledger is immutable and transparent. Every transaction is recorded, time-stamped, and publicly auditable. Fraud becomes exponentially harder, and trust is embedded in the system itself, not in any single authority.

4. Reduced Risk of Centralized Failures

Since blockchains are decentralized, there’s no single point of failure. The network keeps functioning even if multiple nodes go down, making it inherently more resilient than centralized banking infrastructures.

So, Why Are Banks Afraid?

1. Disintermediation

Blockchain technology threatens to cut out the middlemen—banks included. In a future where people can securely lend, borrow, or transfer money peer-to-peer, the role of traditional financial institutions shrinks dramatically.

2. Loss of Control

Banks and governments currently control monetary policy and financial flows. A truly decentralized financial system powered by blockchain could diminish that control. That’s unsettling for institutions used to calling the shots.

3. Regulatory Uncertainty

Blockchain operates in a legal gray area in many countries. Banks prefer predictability, and they see the blockchain ecosystem—particularly crypto—as a regulatory minefield.

4. Legacy Systems and Resistance to Change

Most banks operate on decades-old infrastructure. Transitioning to blockchain-based systems would be costly, complex, and culturally disruptive. It’s easier to patch old systems than to rebuild them entirely—even if that rebuild could yield a better system.

What the Future Might Look Like

We’re not suggesting that banks will vanish overnight. More likely, we’ll see a hybrid future—where traditional banks adopt blockchain technologies to streamline operations while new decentralized platforms carve out their niche. Think JPMorgan’s blockchain-based JPM Coin or CBDCs (Central Bank Digital Currencies) being explored globally.

Still, the tension between innovation and institutional preservation will persist. Banks that embrace the shift could thrive. Those that resist may find themselves relics of a bygone era.

Final Thoughts

Blockchain isn’t just a technological upgrade—it’s a philosophical shift. It reimagines money, trust, and power in the digital age. For a world hungry for financial transparency, efficiency, and inclusion, blockchain offers a compelling solution.

But make no mistake: disruption is rarely comfortable. And for the gatekeepers of the current system, the threat is very real.

More relevant updates, check here